Table of Contents

BCBS 239 Principles: Complete Guide for 2026

The blog explains how BCBS 239 tackles the industry’s persistent risk-data fragmentation by establishing standards for governance, accuracy, completeness, and timely reporting. Effective adoption demands integrated architecture, strong ownership, automated pipelines, and ongoing validation. With solutions like OvalEdge providing lineage and governance control, institutions can move past checkbox compliance toward reliable risk visibility and more resilient, well-informed decision-making.

Too many banks and financial institutions still scramble when markets wobble.

Risk data sits scattered in legacy systems, reports take days, and by the time leadership sees exposure numbers, it’s often too late. Regulatory teams grow uneasy. Senior managers lack clarity. In a crisis, that lag can mean mis-priced risks, sudden liquidity shocks, or even regulatory sanctions.

Many banks still face similar challenges, even years after the Basel Committee introduced the BCBS 239 principles to prevent exactly these situations. These principles reshape how institutions aggregate and manage risk data, strengthening governance, improving data quality, and reducing systemic vulnerabilities across the industry.

In simple terms, BCBS 239 exists to protect financial institutions and the entire financial system from the ripple effects of poor risk visibility. Yet progress remains slow. PwC’s 2024 summary of the latest Basel Committee assessment found that only 2 of 31 G-SIBs are fully compliant, and no single BCBS 239 principle has been fully implemented by all banks.

In this guide, we’ll walk you through what BCBS 239 really means, why it matters, the 14 principles you need to understand, and the practical steps to implement them. You’ll learn how strong data architecture, clear governance, and reliable reporting create resilience, especially during times of market stress.

We’ll also show how platforms like OvalEdge can support these implementation efforts by centralizing data governance and improving lineage visibility. By the end, you’ll know how to turn BCBS 239 from a regulatory requirement into a competitive advantage.

What is BCBS 239?

BCBS 239 principles define the Basel Committee’s framework for effective risk data aggregation and risk reporting. The principles set clear standards for governance, data quality, IT architecture, and timely reporting across financial institutions. The framework improves the accuracy, completeness, and integrity of risk data under normal and stressed conditions.

Banks use BCBS 239 principles to strengthen decision-making, address data gaps, and meet supervisory expectations. Regulators rely on these principles to assess compliance and ensure consistent risk management practices.

Why BCBS 239 matters for risk data aggregation & financial stability

The global financial crisis revealed a harsh truth: financial institutions lacked the ability to rapidly process and consolidate risk data across business lines. Fragmented systems, inconsistent reporting, and slow data aggregation left banks unable to understand their true exposure during market stress.

BCBS 239 addresses these challenges by setting expectations around:

-

Strong governance and accountability

-

Robust risk data aggregation capabilities

-

Clear, useful, and timely risk reporting

-

Active supervisory oversight

These improvements strengthen financial stability by giving institutions faster visibility into exposures, concentrations, and stress scenarios. Banks that build mature risk data capabilities also gain operational benefits, including more informed decision-making, stronger governance practices, and better crisis preparedness.

That’s why BCBS 239 remains a foundational part of modern risk management.

|

Stat: Gartner research cited by IBM shows that poor-quality data costs organizations an average of USD 12.9 million per year, highlighting the measured cost of inaccuracy. |

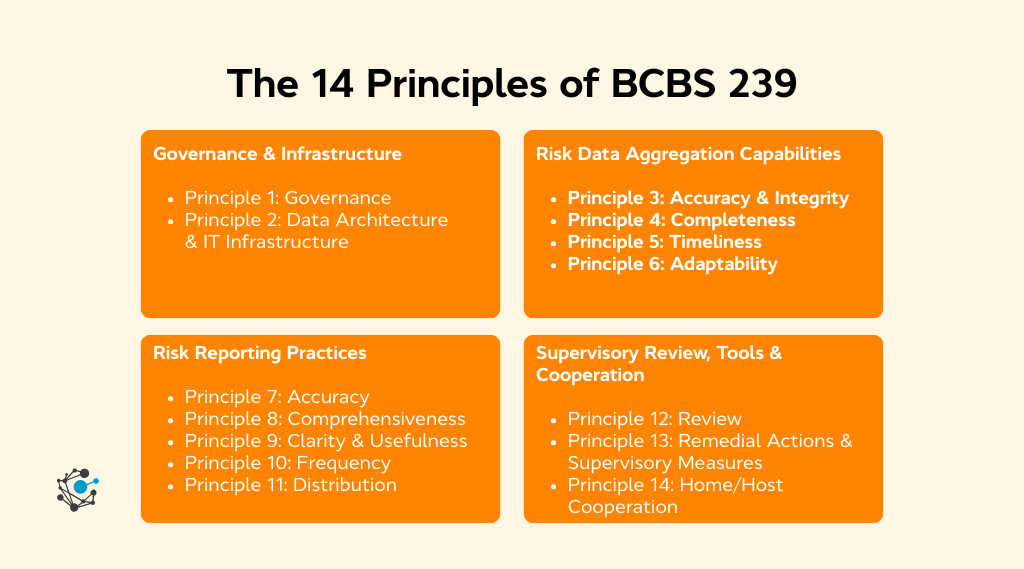

The 14 principles of BCBS 239: Overview & categories

BCBS 239 outlines 14 principles grouped into four themes: governance, risk data aggregation, risk reporting, and supervisory review. Each principle sets an expectation for how financial institutions should manage and report risk data, especially under time pressure or market stress.

Together, these principles create a framework that helps banks achieve a single, reliable version of risk information across the enterprise.

Governance & infrastructure

-

Principle 1: Governance

A strong governance framework sits at the core of BCBS 239. Senior management is expected to take ownership of risk data quality, reporting processes, and compliance oversight.

This isn’t just about signing off on reports; it means embedding accountability into operating models and ensuring leadership understands how risk data flows across the organization. Strong governance reduces ambiguity about who owns which datasets and ensures that decisions are based on accurate, trusted information.

-

Principle 2: Data architecture & IT infrastructure

Banks need integrated, scalable, and automated data systems that support enterprise-wide risk data aggregation. BCBS 239 pushes institutions to move away from fragmented legacy platforms toward centralized architectures that create a single view of risk.

Effective infrastructure enables standardized data definitions, reliable lineage, automated reconciliation, and secure data sharing across jurisdictions. Without this foundation, even the best governance frameworks will struggle to function.

Risk data aggregation capabilities

-

Principle 3: Accuracy & integrity

Risk data must be accurate, consistent, and validated before it reaches decision-makers. This principle emphasizes the need for strong quality controls, automated checks, and reconciliation processes that prevent discrepancies across business lines.

When institutions lack accuracy and integrity, they risk presenting leadership with conflicting risk profiles, which undermines strategic decisions and raises supervisory concerns.

-

Principle 4: Completeness

Banks must capture all material risk data across entities, portfolios, products, and geographies. Completeness ensures institutions don’t overlook exposures hidden in smaller business units or complex structures.

When data is incomplete, risk concentration can go unnoticed, which weakens an institution’s ability to respond effectively during stress scenarios.

-

Principle 5: Timeliness

Institutions must be able to produce aggregated risk reports quickly, such as daily in normal times, and far more frequently during market volatility. Timeliness allows leaders to react before risks escalate.

BCBS 239 expects banks to build systems capable of generating accurate reports even under pressure, which means eliminating manual processes that slow down critical analysis.

-

Principle 6: Adaptability

Risk data systems must adapt to new regulatory requirements, emerging risk types, organizational changes, and acquisitions. A rigid data environment forces banks into manual workarounds, which increases errors and slows reporting. Adaptability ensures institutions remain compliant as financial markets evolve and as new supervisory expectations emerge.

Risk reporting practices

-

Principle 7: Accuracy (in reporting)

Risk reporting must reflect validated, reconciled, and accurate data. Even minor discrepancies can mislead leadership about the bank’s true exposure. This principle pushes institutions to build reporting processes that prioritize consistency and eliminate the risk of outdated or incorrect information circulating across departments.

-

Principle 8: Comprehensiveness

Risk reports must cover all relevant risk types, exposures, concentrations, and drivers. Comprehensiveness ensures leaders and regulators have a full picture of the institution’s risk profile, rather than a selective view influenced by siloed business units.

A complete report helps in making informed decisions around capital allocation, liquidity planning, and stress preparedness.

-

Principle 9: Clarity & usefulness

Reports must be clear, concise, and tailored to the needs of different stakeholders. Technical jargon, overly complex charts, and poorly structured reports can obscure key insights. BCBS 239 expects institutions to deliver reporting that leadership can interpret quickly, especially during a crisis where clarity directly influences decision-making.

-

Principle 10: Frequency

Risk reports must be produced at intervals appropriate for the institution’s risk profile and the external environment. BCBS 239 highlights the need for increased reporting frequency during volatile conditions, ensuring decision-makers always have current information to work with. Frequency should match both business needs and supervisory expectations.

-

Principle 11: Distribution

Reports must reach the right stakeholders swiftly, securely, and with the appropriate level of detail. Effective distribution ensures that those responsible for managing risk have the insights they need at the moment they need them. Institutions must also maintain secure channels to prevent unauthorized access or data leaks.

Supervisory review, tools & cooperation

-

Principle 12: Review

Supervisors must regularly assess a bank’s compliance with BCBS 239. These reviews examine governance, data quality, reporting processes, and system capabilities.

Regular supervisory assessment keeps institutions accountable and ensures they continue strengthening their risk data frameworks rather than viewing compliance as a one-time project.

-

Principle 13: Remedial actions & supervisory measures

When supervisors identify deficiencies in risk data aggregation or reporting processes, they are expected to enforce corrective measures. These could include remediation plans, timelines, or adjustments to capital requirements. The goal is not to penalize banks, but to ensure their risk infrastructure can withstand real-world stress.

-

Principle 14: Home/host cooperation

Large cross-border banks operate under multiple supervisory jurisdictions, and BCBS 239 requires cooperation between home and host regulators. This coordination ensures consistent oversight, eliminates gaps in risk understanding, and strengthens global financial stability.

Effective cooperation becomes especially important during crises, when timely data and aligned supervisory responses are critical.

|

Did you know? EY’s 2025 analysis notes that remediation of risk-data aggregation deficiencies is now the ECB’s #2 supervisory priority for 2025–2027, with potential escalation measures for non-compliance. |

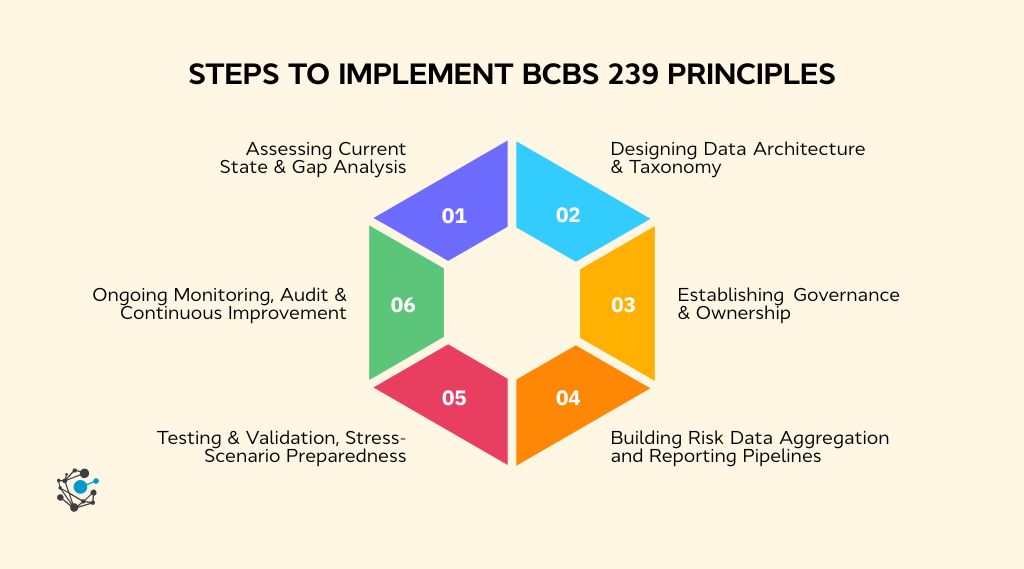

How BCBS 239 principles translate into practice: Implementation steps

When a bank decides to adopt BCBS 239 principles, the journey begins with a methodical process, from understanding current gaps to building robust risk-data systems, testing them under stress, and maintaining compliance over time.

Below is a practical roadmap to help institutions translate the 14 principles into real, operational change.

1. Assessing current state & gap analysis

First, institutions must evaluate existing governance frameworks, data quality, risk-aggregation processes, and reporting practices. This diagnosis reveals where the bank falls short of BCBS 239 expectations, whether data is incomplete, systems are fragmented, or reporting is slow and error-prone.

The gap analysis creates a clear baseline and helps prioritize remediation tasks based on risk, regulatory urgency, and business impact.

2. Designing data architecture & taxonomy

Next, banks should build or redesign a centralized data architecture underpinned by a well-defined taxonomy. This means establishing standard data definitions, such as for exposures, asset classes, risk categories, legal entities, and more, so that data from different business lines can be aggregated consistently.

A clean taxonomy helps ensure that “apples and oranges” don’t get mixed when combining data from different systems. It also improves data lineage and traceability, which supports accurate aggregation and reconcilable reporting across multiple dimensions (entity, geography, risk type).

3. Establishing governance & ownership

Strong governance requires clearly defining who owns which datasets, who is responsible for data stewardship, and who approves the final reports. By assigning data owners and data stewards, the bank builds accountability and eligibility for risk data quality control.

Oversight mechanisms, such as validation committees or data governance boards, help confirm that data flows, aggregation logic, and reporting outputs always meet BCBS 239 principles. This structure avoids a situation where data quality relies purely on manual checks or tribal knowledge.

4. Building risk data aggregation and reporting pipelines

Once governance and architecture are in place, the next step involves building automated pipelines that extract, transform, reconcile, and load (ETL) risk data from multiple internal systems.

Automation reduces manual intervention and the risk of human error. It improves the timelines and consistency of aggregated data and ensures that risk exposures from across the enterprise are rolled up reliably. Over time, solid pipelines support frequent and scalable risk reporting, even during high-volume or stress periods.

5. Testing & validation, stress-scenario preparedness

Banks must test these pipelines under both normal and stressed conditions. That means running aggregation and reporting processes during simulated stress scenarios, such as market crashes or sudden liquidity crunches, to verify that systems deliver accurate, timely output when it matters most.

Despite investment, gaps persist. Deloitte reports that 68% of banks expect BCBS 239 to improve business steering, yet only 21% say they have achieved this, showing how stress-time reporting remains underdeveloped.

This validation ensures that documentation, lineage tracking, data reconciliation, and alert mechanisms actually work under pressure, and helps build confidence that the bank can meet regulatory expectations at any time.

6. Ongoing monitoring, audit & continuous improvement

Implementing BCBS 239 does not end with a one-time rollout. Institutions must monitor data quality continuously, periodically audit pipelines, and refine processes as business models, products, or regulations evolve.

This maintenance ensures long-term compliance and reduces the risk of data drift, regressions, or gaps creeping in, especially in a dynamic banking environment.

At this stage, platforms such as OvalEdge become invaluable. They offer data lineage visibility, metadata cataloging, and governance workflows that help banks keep track of who changed what data, when, and ensure consistent data definitions, ownership clarity, and audit readiness over time.

|

Also read: Data Governance & Compliance Framework: Best Practices for 2025 |

How BCBS 239 fits within broader risk management & regulatory frameworks

BCBS 239 isn’t a standalone regulation. It sits alongside broader supervisory frameworks like Basel III, ICAAP, ILAAP, and various stress-testing requirements. Together, these standards work as an interconnected system designed to strengthen resilience across financial institutions.

When risk data is accurate, complete, and timely, banks can make decisions that align with their capital, liquidity, and risk-appetite strategies more confidently. The ECB reinforces this connection. In its 2024 RDARR Guide, the central bank links governance, data quality, and IT infrastructure as core enablers of reliable stress-test outcomes and consistent risk reporting.

BCBS 239 improves how institutions approach critical components of risk management, including:

-

Capital adequacy decisions

-

Liquidity risk oversight

-

Stress-test preparation and scenario analysis

-

Monitoring risk appetite across portfolios

When BCBS 239 is implemented well, these processes move away from siloed data and heavy manual reconciliation. Leaders gain a clear, consistent view of enterprise risk, which strengthens capital planning, liquidity oversight, and responses during volatile periods.

BCBS 239 becomes far more than a compliance checkbox; it becomes a strategic layer within a modern risk management framework. Institutions that treat it this way communicate risk more transparently, spot issues earlier, and maintain stronger governance across the organization.

How OvalEdge can help in the implementation of BCBS 239

Implementing BCBS 239 principles can be an overwhelming task, requiring robust governance, accurate data aggregation, and effective risk reporting systems.

OvalEdge can simplify this process by offering a comprehensive solution for data governance and compliance. The platform’s features directly address the key areas where banks often face challenges during BCBS 239 adoption.

1. Establishing data governance & ownership

OvalEdge helps banks establish clear data ownership and accountability, which is crucial for meeting the governance principles of BCBS 239. Through the Stewardship Manager, data owners are assigned roles and responsibilities, and escalation protocols are put in place to ensure effective oversight.

The platform also includes a Business Glossary, ensuring consistent definitions across the organization, facilitating standardization and reducing data discrepancies across reports.

2. Enabling Automated Data Lineage and Traceability

BCBS 239 places great emphasis on data lineage, requiring banks to trace the flow of risk data across systems, from source to report. OvalEdge’s Automated Lineage Engine provides granular, end-to-end visibility of data flows, ensuring that risk metrics and reporting paths are clearly mapped and validated.

This feature is particularly useful during audits or supervisory reviews, where traceability is a critical requirement.

3. Strengthening Data Quality & Completeness

Data quality is one of the most important principles of BCBS 239. OvalEdge's Data Quality Rule Builder enables institutions to define proactive rules for completeness, accuracy, and consistency at the source.

The Data Quality Rule Engine automates checks during the aggregation process, ensuring that any anomalies are detected early and addressed promptly. Additionally, OvalEdge’s Anomaly Detection feature identifies potential data issues without requiring predefined rules, enabling faster remediation and reducing manual effort.

4. Supporting Audit Readiness & Regulatory Compliance

Maintaining audit readiness is critical for BCBS 239 compliance. OvalEdge’s Audit Log & Activity Tracker captures every change made to data, metadata, and governance policies, providing a transparent and traceable history of actions.

This functionality ensures that all required evidence is available for regulatory reviews, helping institutions stay prepared for supervisory scrutiny.

5. Facilitating Scalability & Continuous Improvement

BCBS 239 compliance isn’t a one-time achievement; it requires continuous monitoring and adaptation as regulations evolve and new risks emerge. OvalEdge helps institutions scale their BCBS 239 efforts by providing flexible, customizable workflows that can grow with the organization.

With automated metadata crawling and scheduled syncs, OvalEdge ensures that the data inventory is always up-to-date and in compliance with the latest regulations.

6. Centralizing Data Governance Across Systems

OvalEdge's Connector Framework integrates with various platforms, enabling data governance across both cloud and on-prem environments. This integration ensures that BCBS 239 compliance is maintained across all systems, regardless of where the data resides. The platform offers over 150 native connectors, making it a versatile and scalable solution for any financial institution.

By leveraging OvalEdge’s comprehensive data governance tools, financial institutions can streamline the implementation of BCBS 239 and ensure ongoing compliance with regulatory standards. Whether you're looking to enhance data lineage visibility, improve data quality, or maintain audit readiness, OvalEdge provides the tools and support you need to succeed.

For further assistance with BCBS 239 implementation, book a demo with OvalEdge today and start building a compliant, transparent, and scalable data governance framework.

Conclusion

BCBS 239 principles remain one of the most important regulatory frameworks for strengthening financial stability and improving risk visibility. By enhancing data governance, improving reporting quality, and building robust infrastructure, banks gain the clarity and confidence they need to navigate uncertainty.

As you move forward, consider how each principle applies to your institution. How strong is your data governance structure? How reliable are your aggregation processes during stress scenarios? What gaps still exist in your reporting pipeline?

Compliance is not a one-time project; it is an ongoing practice. This is where tools like OvalEdge can support your efforts by providing structured governance, integrated lineage tracking, and cataloging capabilities that make BCBS 239 adoption smoother and more sustainable.

Banks that embrace BCBS 239 not only stay compliant but also gain strategic advantages through better data, faster insights, and more resilient decision-making.

If you're ready to improve your BCBS 239 compliance journey, schedule a free demo with OvalEdge to strengthen your data foundation, modernize your architecture, and build risk reporting processes you can trust.

FAQs

1. What are the key benefits of implementing BCBS 239?

Implementing BCBS 239 helps financial institutions improve data accuracy, enhance risk reporting, ensure compliance with regulations, and strengthen governance frameworks to better manage financial risks and maintain stability.

2. Who needs to comply with BCBS 239?

BCBS 239 primarily applies to global systemically important banks (G-SIBs) and domestic systemically important banks (D-SIBs). However, many institutions voluntarily adopt its principles to strengthen risk management and data governance.

3. How does BCBS 239 relate to Basel III?

BCBS 239 supports Basel III by enhancing risk data aggregation and reporting, providing a more robust framework for risk management, and ensuring timely, accurate reporting for stress testing, capital adequacy, and liquidity risk.

4. What challenges do banks face when implementing BCBS 239?

Banks often struggle with legacy IT systems, fragmented data sources, manual data processes, and a lack of governance. Overcoming these challenges requires investment in technology, data architecture, and strong risk management leadership.

5. How often do financial institutions need to update their BCBS 239 practices?

BCBS 239 compliance should be continuously monitored, with periodic audits, updates based on evolving regulations, and testing for stress scenarios. Institutions must adapt to regulatory changes, internal growth, and emerging risk data needs.

6. What role does technology play in BCBS 239 compliance?

Technology plays a critical role in automating data aggregation, improving data quality, and ensuring the timely reporting of risk data. Advanced data management tools, including AI and cloud-based solutions, are key to meeting BCBS 239 requirements efficiently.

OvalEdge recognized as a leader in data governance solutions

.png?width=1081&height=173&name=Forrester%201%20(1).png)

“Reference customers have repeatedly mentioned the great customer service they receive along with the support for their custom requirements, facilitating time to value. OvalEdge fits well with organizations prioritizing business user empowerment within their data governance strategy.”

.png?width=1081&height=241&name=KC%20-%20Logo%201%20(1).png)

“Reference customers have repeatedly mentioned the great customer service they receive along with the support for their custom requirements, facilitating time to value. OvalEdge fits well with organizations prioritizing business user empowerment within their data governance strategy.”

Gartner, Magic Quadrant for Data and Analytics Governance Platforms, January 2025

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

GARTNER and MAGIC QUADRANT are registered trademarks of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

.png)

.webp)